This is my first guest post. I originally published this here at debtfreemartini.com.

I was at a crossroads. In the eyes of the world, I had it all. I had just graduated and was making over six figures. I had an amazing husband, and of course I bought a big, beautiful house (and lots of stuff to fill it up) and a shiny, new car befitting my new-found status. I also had $500,000 in debt. That’s right. A HALF A MILLION DOLLARS. Whoa.

When I was in school, no one told me that I would have a problem with all of this debt. In fact, they encouraged me getting it. “Student loans are GOOD debt. You’re investing in your future.” “It’s ok to take the maximum out, you need time to study and can’t work as much.” “You’ll have NO PROBLEM paying it off, you’re going to make plenty of money!” Boy, were they wrong!

So, how did I get here? A little less than 6 months after I graduated, I found my dream house. It was beautiful. Just over 3100 square feet, all wood floors, granite kitchen, huge rooms and 2 acres of privacy that I could do whatever I wanted on! It came with a price tag just shy of $300,000. No problem, I thought.

About a month after I moved in, the student loan debt finally came through. In case you didn’t know this about student loans: they give you a six month grace period before they start billing you. I had NO IDEA what my payments would look like. I had racked up around $200,000 in student loans across 9 years of schooling. I thought that would be no problem, but when you add the interest to it, the payments were substantial.

We were still doing ok at this point. I had quite a bit of money saved up during those first six months without any payments. I paid my parents back the down payment they had lent us to buy the house and we bought new furniture, and made some changes to the house to make it feel more like our home. Little by little, that extra money started trickling away.

After a few months, we realized we were living paycheck-to-paycheck. Sometimes, not even that well. Any unexpected expenses were charged to credit cards with a “pay it off later” mentality. We never missed a payment, but we continued to rack up the debt until all 8 of our cards were maxed out. It was time to take a hard look at our finances.

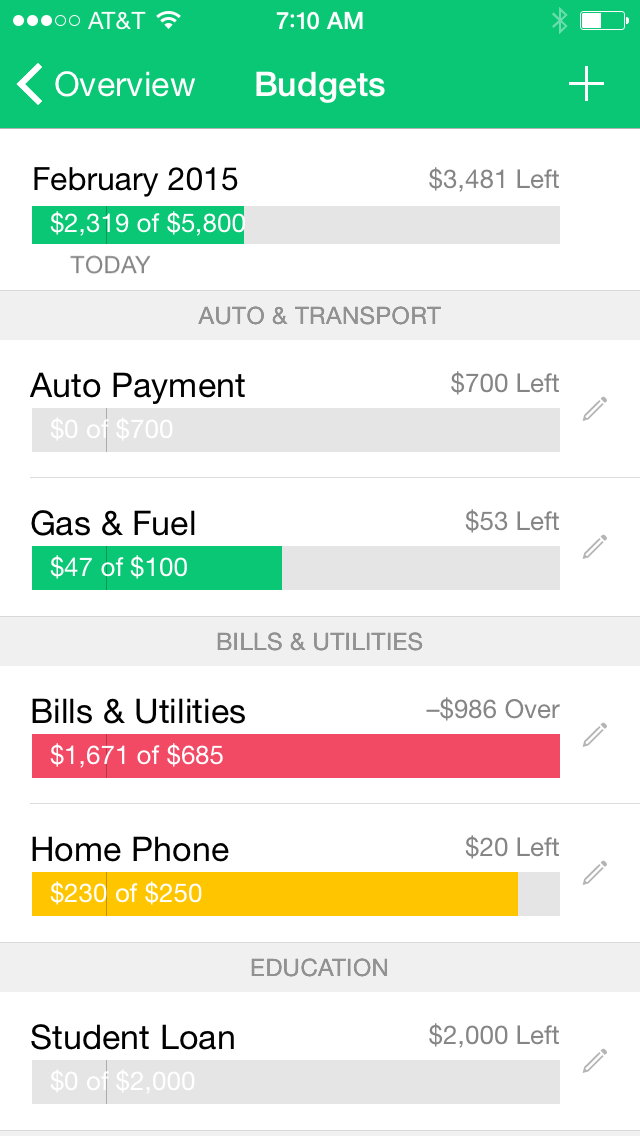

No one ever tells you you can get to this point so quickly. Less than a year into getting a great job and finally taking on the world as on official adult, we were in trouble. We made a rough expense report and budget and determined we were definitely spending more money than we were making. It was time for a change. We wrote down all of our fixed expenses and then checked which of our variable expenses we could reduce or eliminate to save money.

We came up with a few changes that made sense at the time to try and get our expenses well below our income. I refinanced my 2 biggest student loans to run over 25 years (hello, second mortgage!) so the payments wouldn’t be as tight. We cut the extra cable channels and I made a grocery budget we could stick to while still eating real food.

We tried this out for a few months to see how it would help us get on track. We’d have some good months where we’d pay down some of the lower credit card bills. Then, something unexpected would happen and we’d be right back where we were. This wasn’t working. It was time for another, more serious pow-wow.

We sat down again to see what bills could be the most beneficial in getting us out of the mess we were in. There was really only one answer. The house. The place I had both fallen in love with and grown to hate because it was sucking all of our money down the drain. We would have to sell it to get out from under this mountain of debt.

It took just over six months for the house to sell. It was the most difficult thing I have ever had to do. We were giving up on our dream home, all of the plans I had for our future were wrapped up in this one building. It was bittersweet to say goodbye, but I knew it would be for the best in the long run. We packed up our dream home and moved into a 1700sf starter house.

Our new house is the complete opposite of our old house. It is smaller, without the ample storage of the last home, with a tiny lot and surrounded by neighbors (the last house was so private, I never even met any of the neighbors!) It is also newer, more energy efficient and has less maintenance than the older, larger home we left behind. The last house was built for entertaining, this house has hardly enough room for my family to come over for dinner.

Even though it was difficult, I can not deny the financial progress we have made since we made the move. I knew we’d be saving about $1000 on our mortgage, but every other part of home ownership has gotten easier and cheaper since the move as well. The utilities are substantially lower, due to the fact that we bought an energy star home and left a house filled with windows, skylights and sliding doors on every surface. Last month, we paid $47 for our electric bill. Last year at the same time we paid over $400!

It’s been just over six months since we made the move. While we didn’t make much on the sale of our home, it was enough to put a down-payment on our new home and pay off some of the higher credit cards. Since we have moved, we have implemented a budgeting system to go along with the extra money saved from the lower bills. We spend about $75/week on real foods and this month I’m trying out a no-spend challenge to not spend money if the item is not absolutely vital. By doing this, we are saving about $3000 a month. We have paid off all of our credit cards (about $40000), and about $7000 worth of student loans. This brings us from a mortgage of $250000 to $125000 and student loans have gone down to $150000. So we are now at about half of what we would have owed had we not bit the bullet and changed our life!

Saving Sanely owns the blog savingsanely.com where she writes about budgeting, saving money, eating whole foods and working her way from $500,000 in debt to zero. To follow along on her exciting journey, you can find tips and more to the story at the blog, Facebook and Twitter!

Wow… $200K student loan debt is a HUGE burden for someone just starting out in life. Luckily, Australian universities are not like that yet – the conservative government is definitely pushing them in that direction though! Hopefully my daughter will graduate first!!!

It must have been a hard choice to sell the house. Making hard choices is strangely liberating don’t you think?

Oh my gosh, yes! We’ve had it so much better now that we’ve unburdened ourselves from that huge debt.

Thanks for these awesome tips. Thanks so much for linking up this week at #HomeMattersParty. Can’t wait to see what you link up next week.

Thanks, Melissa!