Staying atop financial obligations and finding ways to save money are two the biggest concerns facing most families. Ideally, cash flow balances within a household, with resources left over to stash for the future. Unfortunately, real world conditions are not always ideal. In reality, many families struggle just to keep up with ongoing expenses, much…

Category: Becoming Debt Free

November Update and December Goals

It’s a little late but here’s where I stand for the month of November: Additional debt paid: $7000 Additional savings added: $200 (Christmas is coming, so I spent quite a bit on cyber Monday to knock out my list!) Additional pounds added after Thanksgiving: 5 Additional tests run to find out why I can’t get…

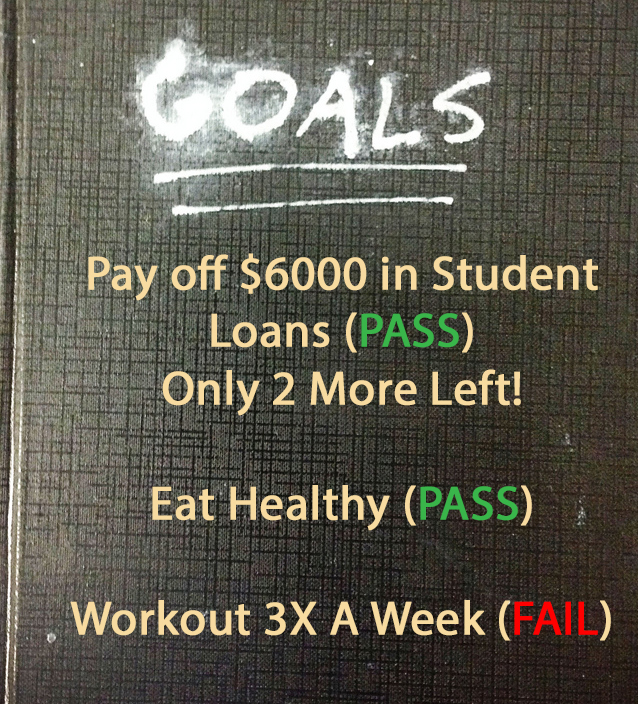

Goals Update July 2015

It’s been a quickly-moving summer, hasn’t it? They say living is easy in the summer, but for me, it’s been busy and hectic! So what does that mean for my progress on my goals? Well, even though it’s been a crazy month, I’ve made some great progress on my goals! That’s right! I’m less than…

Downsizing- Why Buying a Smaller Home was a Great Decision

It’s been a year since my husband and I made the tough decision to downsize from our big, beautiful dream home and start over in a smaller, more manageable one. If you’ve been following my story, you know that a year ago, I had reached my breaking point. I was over $500,000 in debt…

6 Ways You Can Reduce Food Cost to Brush Off Debt

Food expenses are rising day by day and feeding a family within a budget become a challenge for every family . As per the USDA survey, A 4 unit American family spend $800-1200 on their food in every month. Feeding a family in a healthy waywhen debts are already a big trouble that you want…