Budgets are the bread and butter of saving (and more importantly, not overspending). With our February No-Spend Challenge, what better time is there to build a fresh budget to see where your expenses are going?

So how do we go about making a budget? Do you really have to sit down and look over every receipt, every bill? Isn’t there an easier way?

The short answer is yes. If you are new to budgeting and don’t see yourself budgeting every penny, you can make a simple household budget that won’t take much time at all. There are two methods I have used that I found helpful.

The first is to open up your bank account and make a printout of just over a month on your statement. This will have everything you have spent during that time- no need to look up every bill amount individually. You can take different colored highlighters to categorize the expenses or just mark a category with a pen.

Add up each of the categories and see what you’ve been spending previous to having a budget. I always round up to make sure I’m accounting for any surprises. There will be some fixed expenses that you have no wiggle room with (mortgage, minimum payments) and some you will (shopping, groceries, electricity).

Make a quick list of the categories and write down the fixed expenses since there’s no room to change them. Then take a hard look at the expenses you can re-budget, based off of your income and how much you’d like to save. So, for example, if your mortgage is $1200, your minimum debt payments are $1100 and your negotiable expenses added up to $1500 this month and you make $4000 a month, you would theoretically have $200 left at the end of the month. One nice dinner out, a birthday, or any unexpected expense and that could turn into zero, or even having to borrow on the credit card, really fast.

But $1500 of negotiable expenses can be easily changed with a little effort. Look at what those expenses contain. Are you buying lunch every day like I was? That’s $150 a month, easily, gone. How about the groceries? Can you trim down to $100 a week instead of $200 through menu planning? You just added an extra $250 to that budget with minimal effort! See what you can and can’t changed based on your comfort and personal expenses. Be ruthless.

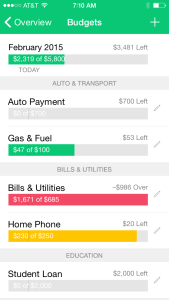

An alternative to this would be to use some free budgeting software. I personally use Mint. It’s free, it links to all of your accounts so you always know where you stand, and it’s available on your smart phone so you can keep the information on you when you’re out shopping wondering if you can afford that next great deal.

Below is a screenshot of my actual mint budget. I like that you can set it to be a strict monthly budget or a rollover budget in which if you don’t spend in one category this month, it rolls over to the next. That is helpful for occasional expenses like gifts or subscriptions that you want to budget for but don’t spend every month. (You can see an example of this under bills and utilities, where I had a huge unexpected bill that pushed our budget over a few months back and it is now being paid out of the next few months budgets.)

Everyone has their own style for how they prefer to make a household budget. You will end up most likely tweaking your budget as you see what you can tolerate cutting out and what you can’t. Think of it as a work in progress and use every month to assess and make it better so that in a couple of months, you will have a highly effective working family budget!

One Comment