Now that I have finally hit the big Three-Oh, I have to take stock of where I’ve been and where I want to go. This is especially significant when it comes to my finances. I have ranged from the care-free teen who thought my first credit card was basically “free money” (thank God for low credit limits, ha ha) to being well on my way to being debt free and having zero credit cards to use even if I needed to.

The lessons I learned in that decade of discovery were not easy to come by. If I had been told where I would end up eventually, I’m not sure if I would have listened, but if anyone finds that my life experiences can help them, I will be happy!

Lesson #1: Credit is not Free Money

When I finally was approved for my first credit card, I knew the basics behind it. They gave you a card with a set amount you could spend and you had to pay it back by making a set minimum payment. Eventually. At a set amount that started at $25 a month, I wasn’t too worried about it. My limit of $300 was quickly met and I ended up making the minimum payment on that for way longer than I should have. It felt like when I had that limit open for spending I had to meet it. It never occurred to me to use the credit only in an emergency and pay it off as soon as I could.

Lesson #2: Student Loans are Definitely not Free Money

This one took a little longer to sink in. When the money is just given to you as a check and you have an unknown time in school where it is deferred, it is much easier to forget that it is slowly growing behind the scenes and will come due with a vengeance when you do finally get done with school.

Lesson #3: Don’t Take Out More Money than You Need

Do you know what I did with the refund check from my first semester in college? My roommate and I headed to Walmart, sick of the free cafeteria food and we each racked up a bill well over $400 once the spree was done. I don’t even remember what we bought. Some clothes, a lot of snack foods and minimal healthy items since all’s we had to store it in was a tiny dorm fridge. I continued this trend all though college, taking out more than I truly needed in order to supplement my meager minimum wage income so I could live the way I wanted instead of the way I should have.

Lesson #4: Always Look at the Consequences of any Major Financial Decision

After one year in the dorm, I really, really wanted out of there. I looked to my roommate to see if she wanted to split an apartment. She wasn’t going to stay at school so I decided to look elsewhere. I was determined. I chose a girl from up the hall that I hardly knew. It turned out to be an awful decision. It started out great, but then things got weird. She had a “secret fiance” that I wasn’t to tell anyone about. She installed a lock on her bedroom door and several times I came home to find her in my room. I had to wait for the lease to end, but I was quickly out of there.

Lesson #5: What Seems Too Good to be True Usually is

A few apartments later, we were given an offer that sounded fantastic. A coworker was trying to sell her little house. She would owner finance it to us for $48000 over 10 years. We would pay less to rent-to-own it than we had been paying in rent and we would have a nice little investment property when I finally finished school. What we didn’t know was 1. Anything about contracts and 2. They had no intention of keeping up their end of the bargain. They left the house trashed and made us clean it just to move in. They refused to take their stuff with them to their new home out of the expansive workshop in the back that we were trying to turn into additional living space. They would come and go as they pleased while still requiring us to pay the taxes and upkeep on the property. When they had the bank come over for an appraisal after we had done some upgrades, we knew they were never going to let us buy the house.

Lesson #6: Stop Trying to Keep up with the Jones’s

After we left the disaster from #5, we wanted to move somewhere nice, without any issues. There was one neighborhood where everyone wanted to live. A little row of really cute town homes that were just above what we wanted to spend, but we thought “what the hell, we can swing it!” We wanted to live there to have a cool place for our friends to come hang out, to get some extra space and to finally not have to worry about fixing everything that went wrong. Unfortunately, this was not that place. For all the extra money we paid, the landlord refused to fix anything. The final straw was when the AC was leaking so profusely we had to put a bowl down to catch all the water. The ceiling turned black with mold and our cats drank the water in the bowl. I put in our notice that we would not be staying.

Lesson #7: Sometimes You Need a Little Help From Your Friends

There were a few times where I couldn’t have made it though to the next month without a little help from friends and family. While I didn’t like asking for help, I know that in those couple of times, I truly needed it. The most important help I received was in getting on track for my career. In any profession, your reputation precedes you and you should always assume anyone you meet might one day be your future boss. I used this line of thinking to build a reputation for myself and have gotten to the level I am at today because of the relationships I have built within my community.

Lesson #8: It’s OK to Ask for What You Want

When I was new to role, just having graduated, my plan for my future was suddenly taken away. The job I thought I had in the bag was given to someone else and I had no future in the town I was living in. I was driving over an hour to get to work daily and had no official home base. I started working with a team I liked to cover a vacation and when the job became available shortly thereafter, I was bold. I asked the manager if she would consider having me as the full time manager. She was excited about the idea but the decision was up to corporate. So, I took a huge risk. I started house hunting in the area and put down my down payment without having secured my job. It was risky, but it also impressed the district manager that I was so committed to working on that team.

Lesson #9: Sometimes You have to Give Up Something to Gain Something Better

One of the hardest lessons I had to learn was that when you get over your head, you have to know when it’s right to give in. When our debt was overwhelming and unmanageable, we made the tough choice to sell our dream home and trade it for a starter home. We dumped the high mortgage and utilities and have gained about $3000 extra per month to use towards paying that debt down.

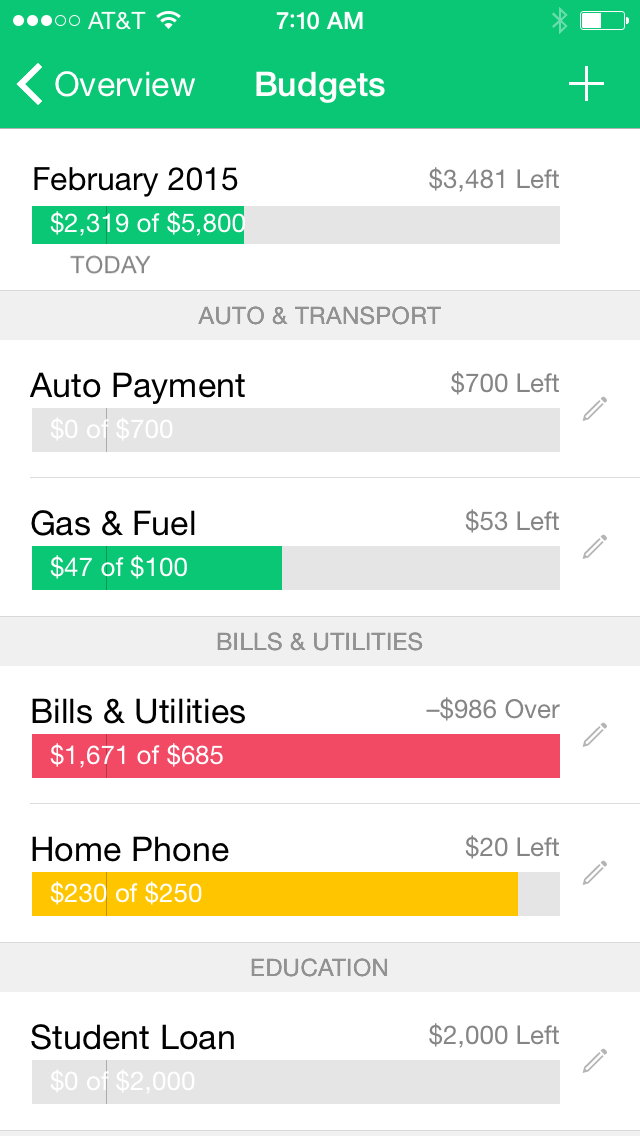

Lesson #10: Budgets are Best

When you don’t know where to turn, budgets are the answer. Whether formal or rough drafts, they can show you where your money is going and where you could potentially cut back to make ends meet or save some extra. For an example of my budget and tips for creating your own, click here.

These examples were just some of the lessons that I learned while growing up in my 20’s. I’m sure there will be plenty more along the way. I’m glad to have gone through these experiences, as they have only made me stronger and are what has brought me to your computer screen today!

These are great lessons! Thank you so much for sharing the at the #SHINEBlogHop!

Thanks for stopping by and for hosting the blog hop! 🙂

Great blog! It took me a little while to learn that credit is not free money…LOL.

Thanks, Lisa! I know it took me WAY longer than it should have, but the main thing is that we got there! 🙂

Budgets are the answer!

I loved how many ways you said debt is not free money. Also, $3,000 extra in the budget from downsizing is an amazing feat. You must be able to breath so much better without that weight on you.

Thanks, Emily! Oh, yes, it makes such a huge difference now! I am able to see a future where before all’s I had was debt on top of debt! Thanks for visiting!

I made many of the same money mistakes you did. Only I’m adding buying a used car that ended up being a lemon. I had to put the repair bills on my credit card and of course refused to stop spending money on clothes, makeup and entertainment. It took me years to pay off that debt. It wasn’t until I started building an emergency fund and stopped keeping up with the Joneses that I finally started building wealth.

OOOH, yes! That’s a good one too! For my first car, I paid cash for it after saving and then it immediately needed to go into the shop (twice) just to be driveable. And then, within a month I got into an accident and it was totaled. Sad, sad day! 🙁

#1 Oh Yeah! I spent my 20’s learning that lesson while digging out of credit card debt for what – I had no idea what that money was spent on. Great points indeed!

Thanks, Toni!

Budgets are awesome and you’re right nothing is for free. It’s hard to think about the consequences.

Thanks, Laina! I agree but it’s harder when you DON’T think about them!

Sometimes knowing when to accept a little help can make a huge difference. I feel like I learned a lot of the same lessons in my 20s.

Thanks, Mel! It’s amazing how much we grow in such a short time!

I am super lucky to some how come out of my childhood as a saver. I saved at school and worked a few jobs which I used all the money to save. I didn’t go out to eat or spend money on anything else. I didn’t get into credit card debt or any debt for that matter. My biggest problem came when I got my first job and finally want making a good living and I thought that I deserved to spend the money after all that time of saving. I wasted money eating out and on stuff that I didn’t really need! Luckily I snapped out of it before it was too crazy but I think of all the money I could have saved if I didn’t go through that little period of crazy spending. Learning lessons are always great because they stay with us!!!

That’s so great that you were able to stay on top of your finances! And also that you quickly recognized the unhealthy pattern of spending!

Oh how I can relate. It’s a if I’d have known then what I know now situation, sadly! Thanks for stopping by and linking up at the Home Matters LInky Party

Thanks for having me and for commenting!

“Sometimes You have to Give Up Something to Gain Something Better” this is such an important concept to understand. Last Summer I gave up a very comfortable job and took on a new role in an entirely different part of our company. It was a big step for me to leave a team I had been with for 4 years (ever since interning and starting full-time) and honestly was unsure about the change. Ultimately, though, it’s been an awesome experience. Not only was it a promotion, but I also feel more challenged by my manager and others I work with to develop into a better business professional. I’m so thankful I gave up my comfortable, “good” job to take on the new challenge.

Thanks for stopping by and sharing, DC! It is sometimes difficult for us to choose the harder, unbeaten path, but it can often be the better one! Not every difficult decision will end up being the best one for every person, but you won’t get somewhere different if you always go the same route!

These are great tips. I’m way out of my 20’s now but I think it’s important for young people to know how to take care of the money they work hard for.

Thanks for sharing with Small Victories Sunday Linkup and hope you join us again this weekend! Pinning to our linkup board.

Thanks for hosting the linkup! This isn’t necessarily a post just for young people, but it was timely for me as I just turned thirty. It’s never too late to get your finances in order though!

Yikes, your apartment stories sound pretty insane. That also really, really sucks about the rent-to-own catastrophe. It is pretty up there in terms of bad rental situations that I have heard about.

Yep we’ve had some doozies haha but luckily it’s all behind us now!

Great that you know all of these great tips now as they will help you as you continue to grown in your career and in your life. Thanks for taking the time to share with others and for sharing at our FB Share Day

Thanks, as always, for hosting Susen!

I had to learn a lot of these lessons the hard way in my 20s. Great advice here!

Thanks for sharing at the #HomeMattersParty – we hope to see you again next week 🙂

Thanks, Brittany! Often, lessons learned the hard way are those that are best remembered and never repeated! Thanks for hosting at the #homemattersparty!

These are great tips. I keep trying to tell my 20 year old sister these things, but I think she has to learn it through experience. I guess we all do!

Yes, when we’re that age, it’s hard to get the experience from other’s advice. We think we know what we are doing and are anxious to prove it! The good news is that I’ve found a lesson hard-earned is the best learned, so I’m sure that even f she makes some of the same mistakes she will have you to help her when she needs it down the road and will end up just fine! 🙂

wow number 5 is brutal. I am so sorry you had to experience that!

In college I was always the one saying “You’re going to spend your money on what?!” I also grew up very conscious of the fact that money does not grow on trees. Hopefully your tips find their way to some of those wayward 20-somethings.

Thanks, Marie! Yes it’s amazing how quickly my perspective changed once those bills started rolling in. It makes it where I’m refusing to take on any debt even if I know it’ll be no problem to pay it so that I can never worry about that again!

These are great tips! I wish they made everyone applying for a credit card read this as part of the disclaimer!

Thanks! Haha- could you imagine? “See savingsanely.com before proceeding!”

These are great $$ tips, thanks for sharing on the TALENTED TUESDAY link party. Thankfully my father is a banker, so I didn’t have to learn any of these lessons the hard way! 🙂

Thanks, Aspen! That must have been helpful to have all of that knowledge at your disposal!