How did everyone’s Frugal February Challenge go? Did you stick with the plan of not buying anything not necessary for survival or did the month’s festivities put a damper on your plans?

I stuck with it pretty well. We did have a couple of setbacks. We went out to eat twice. I accounted for Valentine’s day expenses when I wanted to start the challenge, but I overspent a bit. Between my husband and I we spent just about $125 on gifts and food, which was more than I would have liked. The hubs also bought tickets to an MMA fight he and a friend will be going to next month, which was well over the planned budget, but will be a fun break for him next month.

Even though we strayed a bit from the plan, we did manage to make our goal and then some of saving $3000 towards eliminating the student loan debt. We paid off one of the hubs’ loans and made our regular payments on the others. I made the last payment on my smallest loan as well. So that’s two out of 7 student loans eliminated! All in all, we paid about $4000 this month, so I would sat the challenge was a success!

The great news for last month was that the hubs finally got the job he had been trying for. This will mean a steady paycheck with a possibility for overtime hours. After getting his first paycheck this Friday (about $650) I did some quick math and determined that his new income has the potential to cover all of our day-to-day expenses and bills with the exception of the debt payments we have to make on the student loans.

This past check did have some overtime hours on it, so I’m not sure if it will be indicative of an “average week” or a “good week” and that will be the deciding factor in whether we can do what I’ve been hoping we could for a long time: Live on just one income. And not mine!

The question is, is this a feasible task or just wishful thinking? I’m going to take this month to try and figure it out. If we can make it work, we can put about $75,000 towards our debt over the next year. That would be AMAZING! If we can keep that pace up, we could be debt and mortgage free in less than 5 years! WOW!!!!

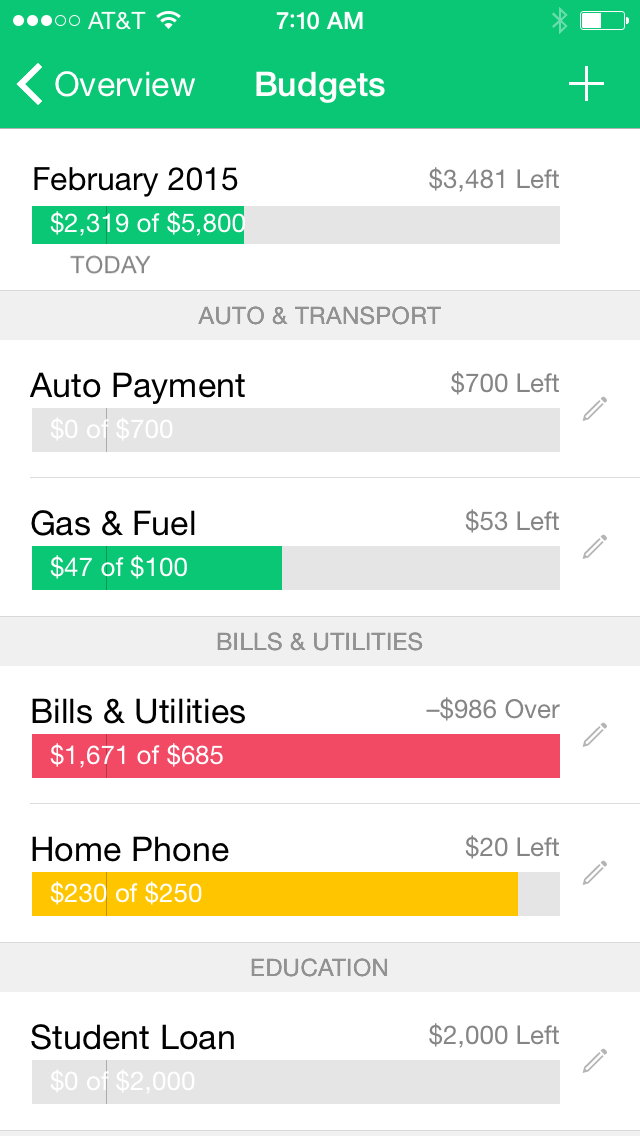

So let’s crunch some numbers! Here’s what our expenses look like in a normal month:

Bills:

Mortgage: $1100

Electric: $50

Gas: $50

Phone: $200

Satellite: $200

Internet: $50

Water and Trash: $100

Car Payments: $700

Groceries: $300

Total: $2750

Current Student Loan Debt:

Minimum Payments: $1400

Goal Payment: $7000

Total Owed: 165000

Now, in order to make this happen, I don’t think we can keep the bills as they stand. There isn’t enough wiggle room in the expenses to work with the Hubs’ checks. He would have to consistently make more than $700 a week for this to work as we are. So, I will be looking at where we can cut back to make this change more comfortable and a real possibility (satellite and phone bill, I’m looking at you!)

Over the next month, we will attempt to only use my check for paying off debt. We do have a good cushion in the checking account right now so it should be fine, but I’d like to make it work without dipping into the emergency fund. That will tell us if this is a lifestyle change we can make permanently or if we will have to keep whittling at the budget or take some of my income for bills as well. Wish us luck!

What are your tips for staying on a tight budget or living on a single income?

Congrats on making such a big payment towards your student loans- that’s awesome!

Thanks, Kristin! We just keep plugging away and putting any extra towards it. I’m so ready to slay the debt dragon! 😉

We switched from Satellite to Roku box with Netflix and Hulu+ a couple months ago and just love it! We really enjoy watching old series together as date nights and never have to watch commercials. You have a great, positive attitude, which really helps for sticking to the plan. Best of luck! I enjoyed finding you and this post on Sarah Titus’ “Frugal Fridays.”

Thanks, Rebecca! I might just check that out- it will take some convincing for the hubs though! 🙂

One trick I picked up was to get a credit card that gives cash back…and then put that money each month towards bills!

That’s a great idea if you have the diligence to pay it off each month- I’m going for having no credit cards because they can easily get me in trouble.

Good for you! I wish we would have done more of this before I got sick. You never plan to have a stroke at 45 and lose 1/2 the income of your household and for your doctor bills to revel the national debt! It is so good that you are doing things wisely, you should be really proud of yourselves!!

Thanks so much Nikki! I’m sorry to hear you’ve had such a misfortunate past. It’s good to see that you are making the most of what you can do and have a sense of humor about you still!

I feel like I know you since we blog about very similar things AND have the same layout. I laughed so hard when I got to your page. We must think a lot alike! 😉

I found you through Small Victories Sunday and I know you can live off of one paycheck! I think what you are doing is very smart. Keep it up and you’ll be so happy with the rewards. I’d love if you came to link up at my page too. This is a perfect post for my Share the Wealth Sunday link up!

Thanks, Hannah! Will definitely be checking out my long lost twin page, haha!

Wow! Congratulations on making such great strides toward getting out of debt! When we were working on paying off our student loans, doing a No Spend Month really helped give us a boost too. I know your journey will inspire so many!

Thanks, Shannon! I really appreciate the support! 🙂

My husband and I are always trying to find new ways to cut back on our expenses.

We gave up our Verizon phone plan and went to Republic Wireless for our cell phone. We save SO MUCH money with our new plan. I’d look into that if you’re searching for a way to lower your phone bill!

Thanks for the tip, Marie! We’re locked in a contract with our phones right now, but can make some changes within our carrier for sure to drop the bill amount for now.

This is a great post, great way of keeping you both accountable. I will be following to see how it goes for you. Budgeting saved our sanity and our marriage years ago when the economy tanked. We used to just spend money because it didn’t matter, but we didn’t have a reserve when trouble hit. We learned to do things differently. We don’t have car payments and no satellite right now, but kid needs, and our mortgage are our biggest issues. Thanks for linking up to #smallvictoriessundaylinkup.

Thanks, Jessica! It is amazing how quickly you can go from hating budgets to loving them when your circumstances change! Budgeting is definitely the factor that is allowing us to make huge dents in our debt and hopefully soon be 100% debt free!

Wow, great savings rate this month! My wife and I just switched from 2 to 1 income in January of this year. It was a big transition, but we’d been budgeting based on one income for years, so it worked out okay.

Our biggest challenge was realizing that we had to amortize big upcoming expenses (like prop taxes) over the course of a few months, rather than letting them come up all of a sudden.

When we had two incomes, we could absorb those ‘surprises’ in the natural flow of things, but it got a lot harder with a big income source out of the picture!

We’re also able to cut a lot out of our monthly budgets by using republic wireless for phone service ($38.00 a month!) and not having any TV–we use internet and netflix for our media consumption. Sounds crazy, but it saves us about $300+ a month that we can invest or save instead.

Keep on saving,

Charles

Thanks, Charles! Those little expenses definitely add up and it’s good to cut anything you don’t really need to save for something you do!

Hey! I could have sworn I’ve been to this blog before but after reading through some of the post I realized it’s new to me. Nonetheless, I’m definitely delighted I found it and I’ll be book-marking and checking back frequently!

Thanks, Marcelo!